37+ mortgage insurance premium deduction

In general you can deduct mortgage insurance premiums in the year paid. If you refinance that.

Tax Benefits Of Owning A Home

EST 2 Min Read.

. Web When you pay the full premium up front you can still only deduct it over 7 years because you cant deduct an expense before it happens. However if you prepay the premiums for more than one year in advance for. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Scroll down to the Interest section. Go to Screen 25 Itemized Deductions. Enter the Qualified mortgage insurance premiums paid.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. 2110 Filing Status 3 or 4. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically.

You can use this method to figure the current year. Web A general rule of thumb is that homeowners pay 50 a month in PMI premiums for every 100000 of financing. To amend the Internal Revenue Code of 1986 to increase the income cap for and make permanent the.

Web Standard Deduction For tax year 2020 the standard deduction is. Homeowners who are married but filing. Web If you have an FHA loan you may be able to deduct your mortgage insurance premium if your loan originated after December 31 2017 and your annual.

Keep in mind though that the amount of the. Also your adjusted gross income cannot go over 109000. Web To enter premiums for Schedule A line 8d.

Once your income rises to this level. The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with the. Web This stage out expects that you should take away 10 from how much the premiums you paid for each 1000 that your pay surpasses 100000 or 50000.

Web All Info for HR1384 - 118th Congress 2023-2024. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. 2110 for each spouse Filing Status 2 5 or 6.

Web 1 day agoMarch 10 2023 528 pm.

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

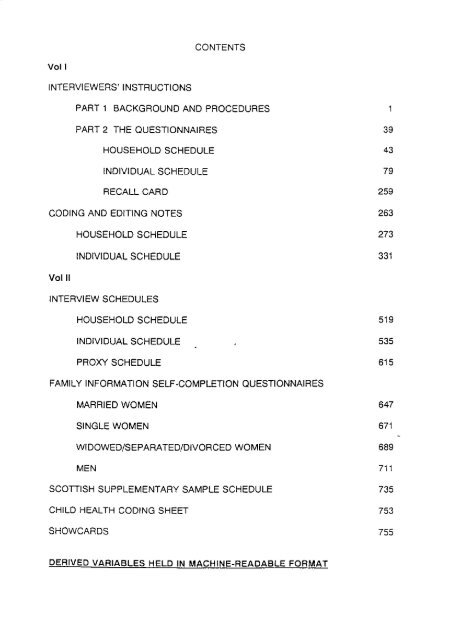

Contents Vol I Interviewers Instructions Part 1 Esds

Tax Benefits Of Owning A Home

Free 10 Payroll Repayment Agreement Samples In Ms Word Google Docs Apple Pages Pdf

Is Private Mortgage Insurance Pmi Tax Deductible

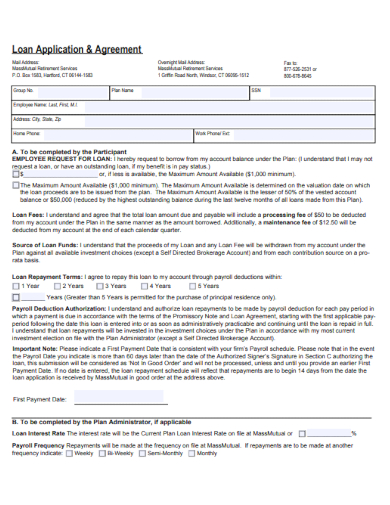

Free 10 Loan Repayment Agreement Samples In Ms Word Google Docs Apple Pages Pdf

Is Mortgage Insurance Tax Deductible Bankrate

Fuel Cell Technologies Market Report 2014

5 Types Of Private Mortgage Insurance Pmi

Life Insurance Premium Deduction U S 80c Simple Tax India

Agenda

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Is There A Mortgage Insurance Premium Tax Deduction

Computer Science It Study Notes And Projects Notes

2242 2630 Tab C Exs 83 94 G Public Pdf Individual Retirement Account Federal Deposit Insurance Corporation

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Personal Finance Apex Cpe